GameStop’s business

GameStop is a brick-and-mortar videogame retailer that you might correctly assume wasn’t doing very well in recent years as digital distribution channels became more and more preferred among gamers. The pandemic didn’t help the company either as the number of people shopping in person decreased. GameStop’s management recently committed to a transformation plan to ensure the survival of the retailer. To simplify, the transformation plan puts licensed merchandise in the foreground to appeal to the enthusiast layer of gamers. However, the recent surge is not because of this transformation plan.

GameStop on the market

Lots of hedge funds did not believe in GameStop’s transformation plan, hence started shorting it, in the hope that the stock would fall. To put the story in context, GameStop’s stock price alternated between $2,80 and $6,31 in the first half of 2020, which of course is a large range, however, it’s nothing compared to what happened after.

To continue, I first must clarify what short selling is. As per Investopedia:

“In short selling, a position is opened by borrowing share of a stock that the investor believes will decrease in value by the set expiration date. The investor then sells these borrowed shares to buyers willing to pay the market price. Before the borrowed share must be returned, the trader is betting that the price will continue to decline and they can purchase them at a lower cost.”

Or in Layman’s terms: The basic concept is, that in order to short sell, first, you must borrow shares from investors to sell them at market price in the hope that the price would fall later and when you have to return the shares to the original owner, you buy the equity at the lower price and pocket the difference.

The investors betting against GameStop overshot and by the end of July 2020 the short rate on GameStop was above 100% of float. Float is the number of available shares that can be freely bought on the market and are not in the hands of insiders, employees or major shareholders. Obviously, if a stock’s short rate is above 100%, meaning more shares are sold short than available in the market, the return of said shares to the original owner could be quite hectic, to say the least. The short rate in January 2021 was consistently above 140% and did not decline until the time of writing this article.

r/WallStreetBets

This is the “loophole” an online message board on Reddit, called WallStreetBets discovered. They believed if enough retail investors would buy the stock, a short squeeze would follow.

“A short squeeze occurs when a stock jumps slightly higher forcing traders who had bet that it price would fall, to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price.” (Investopedia)

Lots of retail investors bought call options expiring 2021.01.29, leading to a gamma squeeze. As they bought call options, the brokers that selling the options typically cover their position and buy the underlying stock. The more call options bought, the more stocks brokers would have to buy leading to an increase in price. As millions of retail investors have bought the share to exploit the short squeeze, market makers can’t properly hedge and are forced to buy shares at any price. Short sellers have to return the borrowed shares also at any price at expiration date. It wouldn’t be a problem if their positions were covered, but they are naked shorts meaning they do not have the necessary shares to cover the positions and they have to buy it from the market. As if these factors aren’t enough, FOMO (fear of missing out) also plays an important part in upping the price as millions of small investors discovered the GameStop stock as the news spread.

All of the squeezes and factors have led to the following:

GameStop’s stock is up 1755% year to date which even captured Elon Musk’s attention, whose company, Tesla also went through a surge in 2020 and its 1Y change is at 664%.

Outcomes

One of the hedge funds that shorted GameStop is Melvin Capital, which reported to lost billions of dollars and even received an infusion of $3bn on Monday, 2021.01.25 in order to shore up the fund from Capital and Point72. Of course, it would be naïve to say that retail investors and redditors defeated billion-dollar hedge funds in this David and Goliath fight, it’s more than likely that other hedge funds also exploited the situation and the fuss around GameStop.

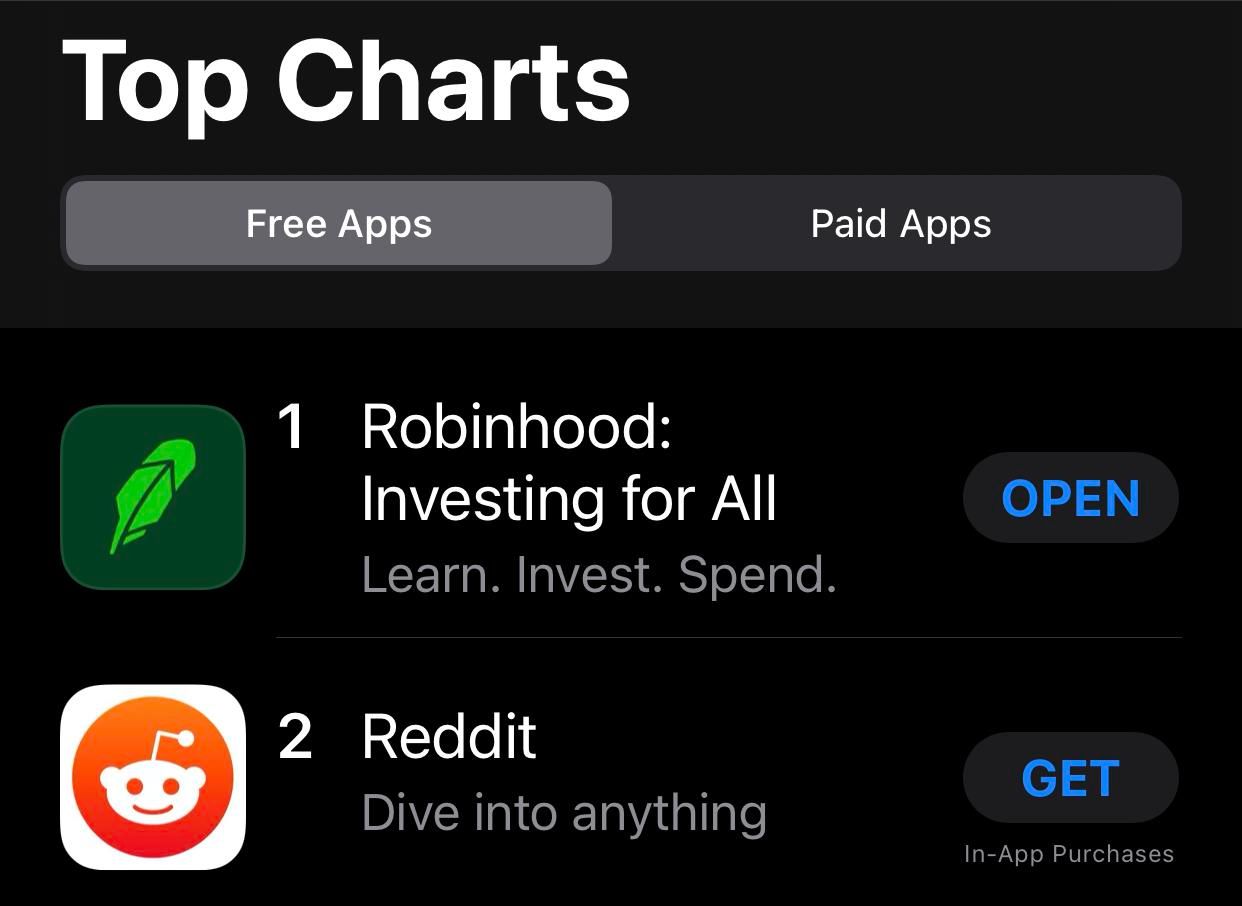

To highlight how big of a fuss is around GameStop let’s see the volumes on the exchange and the current trending page of App Store in the US.

The 65 day average volume is 24,85 million shares.

Robinhood is the most well known, commission-free trading app in the US, while Reddit is the site that gives home to the WallStreetBets community.

The future

What will all this bring in the future? First, AMC, the struggling cinema giant is surging as well, which was also heavily shorted, and so BlackBerry among others. Some interpret this as a war between retail investors and hedge funds, some say there is something wrong with the market, and others claim the efficient market hypothesis is overthrown.

One thing is sure, small retail investors never ever had easier access to the stock exchange market than now.

Tools Used

- Python (yfinance, pandas)

- DataWrapper

This is not a financial advice. The article is based on data from 2021.01.27 after market close.